There's a New Tariff in Town

We're Ranking the Last 50 Years of Economic Shocks in Canada. Where do the new tariffs fit in? What is the biggest and baddest of them all?

Tariffs: On Both Sides of the Border, People Don’t Know What to Think

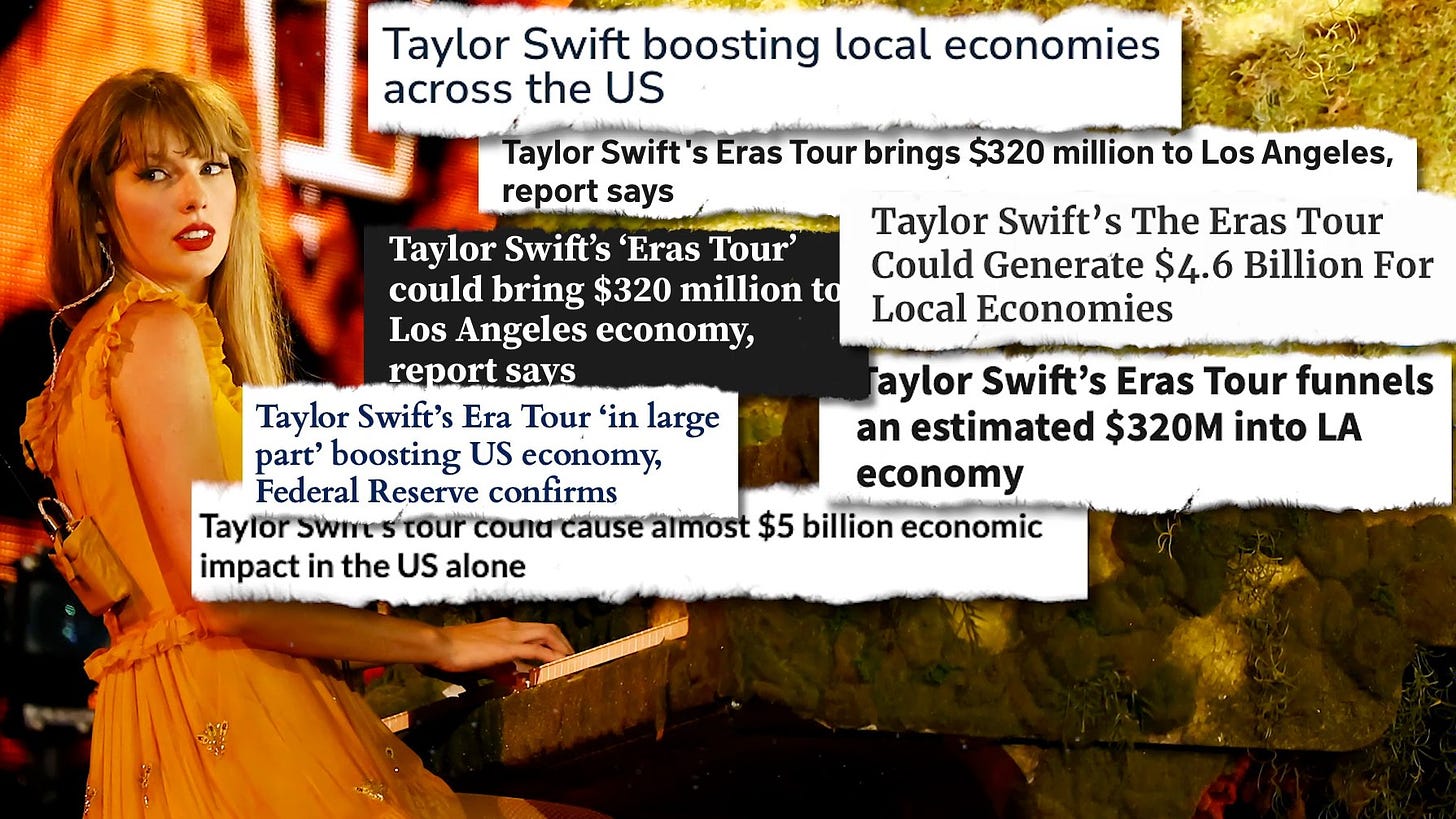

Tariffs are a wonky subject. The kind of thing economists love to debate and most regular people ignore—until their grocery bill creeps up, their job gets outsourced, or some politician starts screaming about an economic war. But everyone is interested in tariffs today. Here’s a google trend analysis comparing search for tariffs to Taylor Swift.

But are tariffs really bigger than Taylor Swift?

In a move that's left economists scrambling and consumers clutching their wallets, President Donald Trump today imposed sweeping new tariffs: 25% on imports from Canada and Mexico, and a further increase of 10% on Chinese goods.

The Trump Tariffs: Crisis or Opportunity?

My mother was nine years old and on the ferry to Prince Edward Island when Canada’s entry into World War II was announced. The captain read out the news over the ferry’s intercoms. She liked to tell the story of how she turned to her mother and asked, with the solemnity only a child can muster, if they were all going to die now. A superstitious worrier, she never did care to visit PEI again in her life. That moment left a mark on her—not just as a memory, but as an emotional boundary she never crossed again.

I have a nine-year-old daughter. And as the media shrieks about the Trump tariffs, about how they are a "battle for Canada’s economic, political, and social survival," I think about what impact this will have on her life in the coming days, months, and years. In the fullness of time, is this a crisis? Or is it a moment for Canada to recalibrate, to build something stronger, more self-reliant, and better?

Canadians and Americans alike are struggling to figure out what it all means. Pollsters, trying to gauge public opinion, sometimes frame tariffs as “a tax on imports” to help respondents grasp the concept. That’s fair. Tariffs are a tax on imports. But that word—tax—has a way of making people skittish. Who likes taxes? Maybe that's why, when tariffs are framed as a tax, support tends to drop.

The question is how worried should we be?

Here’s a ranking of Canada’s modern economic shocks:

Ranking Canada’s Biggest Economic Shocks

🔴 Existential-Level Crises (Fundamentally Reshaped the Economy)

The 1981-82 Recession – Soaring interest rates (reaching 20%+), double-digit unemployment, and a collapse in manufacturing devastated businesses and homeowners. A complete economic reset.

The COVID-19 Pandemic & Supply Chain Meltdown (2020-2022) – Mass layoffs, government bailouts, and record money-printing led to inflation and permanent changes to work, retail, and healthcare.

The 1973 Oil Crisis – The global price shock reshaped Canada’s energy policy, inflation, and industry, leading to years of economic turbulence.

🟠 Major Shocks (Severe But Not Existential Disruptions)

The War in Ukraine & Commodity Shock (2022-Present) – Energy and food price spikes benefited some sectors (oil, wheat) but hurt consumers and manufacturing.

The 2008 Financial Crisis – Canada’s banks survived better than others, but the stock market crashed, housing stalled, and global demand for Canadian exports fell.

NAFTA’s Birth (1994) – Opened huge trade opportunities but forced Canadian businesses to compete harder, changing the economy permanently.

🟡 Tariffs & Trade Wars (Disruptive, but Manageable)

Trump’s 2018 Steel & Aluminum Tariffs – Caused temporary pain for steel and aluminum industries, but Canada responded with counter-tariffs, and the U.S. eventually backed down.

The 2025 Trump Tariffs (New) – These will sting, but Canada has been here before. The key question is whether they’re temporary negotiating tactics or the start of something much worse.

Where Do the 2025 Tariffs Fit?

They’re not an existential crisis—this isn’t the early ‘80s or COVID.

They’re not a long-term transformation—like NAFTA, which reshaped trade forever.

They’re a trade disruption—significant but likely temporary, unless they escalate into a broader economic war.

Bottom line? Canada has survived worse. The challenge now is turning this moment into an opportunity.

But Tariffs are Weird

Tariffs are so weird, they are one of the few economic policies that scramble traditional ideological lines. Are they a nationalist tool to protect local industry? A government cash grab? A price hike passed straight to consumers? A strategic countermeasure against foreign manipulation? Depends on who you ask. And depends on who is involved. Americans have a very different view of tariffs on China (for ‘em) than on Canada (against ‘em).

The Long Game: Crisis or Course Correction?

My daughter is not going to look back on this tariff fight the way my mother remembered the declaration of war. Her childhood will not be defined by the cost of aluminum exports or the price of softwood lumber. What she will remember, if she remembers it at all, is how Canada chose to respond. Because that will impact her life. Did we fold, rage, and complain? Or did we build?

This could be a moment of economic self-realization for Canada. Maybe we stop waiting for a call from Washington and start looking at what we can do to strengthen our industries, attract investment, more fairly share our own wealth, and make our country more productive. Maybe we recognize that growth should not come from dependence but from innovation. And that growth itself, after a certain point, is a factor with diminishing returns.

If this tariff is a crisis, it is only because we choose to see it as one. If it is an opportunity, it is because we make it so. The sky is not falling. The ferry is not sinking. We are not all going to die now. The real question is: what do we do next?

For now, both sides of the border are watching, waiting, and mostly guessing at how this all plays out. The only thing that’s certain? There will be more Google searches.