New Nova Scotia Budget Overview

A Budget is a story we write for ourselves about where our wealth will come from and where it will go in the future

With revenues of $15.8 billion and expenses of $16.5 billion, The Nova Scotia Budget for 2024–25 is estimating a deficit of $467.4 million. That’s about 3% of revenue and brings our total debt to almost $20 Billion.

The most important and useful question to ask when looking at a budget is a deceptively simple question that, if pursued, can bring you to a deep, fair, and balanced understanding of the finances of a place.

Is That A Big Number?

I’m going to just look at the debt number today and share a list of other budget highlights.

There’s a lot of symbolism and philosophy in a budget along with hard choices, practical concerns, and almost always a mix of hope and disappointment. The reason is Scarcity. Scarcity is the basic building block of our lives. If everyone had unlimited access to everything we wouldn’t need budgets. In that land of milk and honey, all our wants would be satisfied. And there’s a pretty good reason to believe we’d hate that world and make a real mess of it. So scarcity, for all its pains, keeps humanity and society between the ditches.

The Debt is a running reminder that we’ve maybe pushed things too far, spent more than we have, been greedy, and robbed from the future.

Bankers have a kind of time machine. They travel into the future and bring back wealth, which they lend to people in the present for a fee. How this time machine action impacts the people in the future is a bit of a mystery but it can go several ways.

First, we might use debt to finance things that last and give benefits over a long time. This is what happens with housing mortgages. A home might last 100 years and go up in value all the time, so a 30-year mortgage is an amazing invention that allows folks to match the payment for all a home offers with the timing of those benefits year in and out. Then, at the end, the debt is paid and the home, an asset, is worth even more than when it was built and makes any interest payments seem like a triviality to the future kids who might inherit that home to live in, rent, or sell. This debt that builds wealth creates useful infrastructure, and spreads costs out to match with benefits is AWESOME. Amongst the smartest things we can do to build a better world.

Then there’s another kind of debt. Imagine the payday loan. Borrowing money to buy short-term benefits and bad stuff like smokes, gambling, and liquor, then paying huge interest that will never be covered by any future good stuff. This debt is terrible. What if you didn’t spend it on smokes? What if you needed the money to pay unavoidable short-term bills just to get by like heat, cell phone, and electricity? Well, you may not have any choice but this situation is even worse. You have a BIG problem that is not being solved but will be compounded even further for people facing the same problem in the future.

So where are we? Is a potential one-year $500m deficit terrible or good? Is a total debt of $20B bad, good, or indifferent?

We talked about certain qualities of debt. Is it used to build valuable assets that increase in value and last a long time? Is it used for a bad purpose, or to fix intractable current-day problems and push off a reckoning to the future? What is the cost of the debt? The interest rate?

In Nova Scotia, it’s pretty clear we’re in a building and growth mode. The government, whatever party is in power, is trying to balance value for money with keeping costs down as much as possible, maybe not buying the cheapest, but finding the lowest cost way to do things. All this will always be a compromise and there have been some spectacular mistakes **Cough**Convention Centre**Cough**, but it’s apparent the intention is good, corruption is low, and the mistakes are small relative to the wealth we are creating.

So, is $500m a big deficit? It’s just less than 3% of the total budget. In the past several years deficits of this range have actually all turned into small surpluses just because of small conservative estimates of revenue and expenses and a few small windfalls such as happen sometimes. This deficit is a normal small amount that experience shows is likely budgeted conservatively and may become a surplus. Prudence and carefulness are good qualities in budgeting.

Last year net debt was $17.77 billion at March 31, 2023, $595.3 million higher than the prior year due to the net acquisitions of long-term capital assets like schools, hospitals, and senior’s care facilities, of $740.1 million and an increase in prepaid expenses of $17.8 million, offset by the $115.7 million surplus.

What about approaching $20 Billion in debt? That seems like a big number. And it for sure is for a regular person or business. But the province isn’t a person or business. It’s a vast almost everlasting collection of capital and wealth-creating assets from people to farms and forest, factories and seas. Wealth literally grows on trees from a provincial perspective, and even better, Nova Scotia has the systems, government, and institutions that create the safety for that wealth to be sustained, shared, and protected.

Still, is $20 Billion a big number? Here are some ways to look at it.

With about a million people in NS it’s about $20,000 for every person. But we don’t have to pay it off now. If we paid it over 30 years like a home that would be about $667 per person a year plus interest. Are the interest rates high? Nope, big entities like successful provinces don’t pay the same sort of interest as individuals. Nova Scotia’s debt currently costs about 3.1% per year. Remember when your interest rate was about 3%?

If we add more people of course that debt per person can go down. All other things being equal, adding 2% to the population as projected this year reduces the debt to about $650 per year in rough numbers.

Sure, but we as people aren’t going to pay individually. The province pays from the wealth we create. Can the province afford this debt? Debt as a percentage of GDP, the sum of the wealth we produce each year, provides a measure of the level of future financial demands placed on the economy by the Province’s spending and taxation policies. A higher ratio means the debt of the Province is more difficult on future generations. The news here is good! This ratio decreased by 1.4 percentage points to 31.7 percent in 2023. Over the past five years, the ratio of debt to GDP has decreased by 1.7 percentage points from 33.4 percent in 2019. We’re actually better off from a debt-carrying perspective than we were five years ago. One of the few post-COVID economies that can say that.

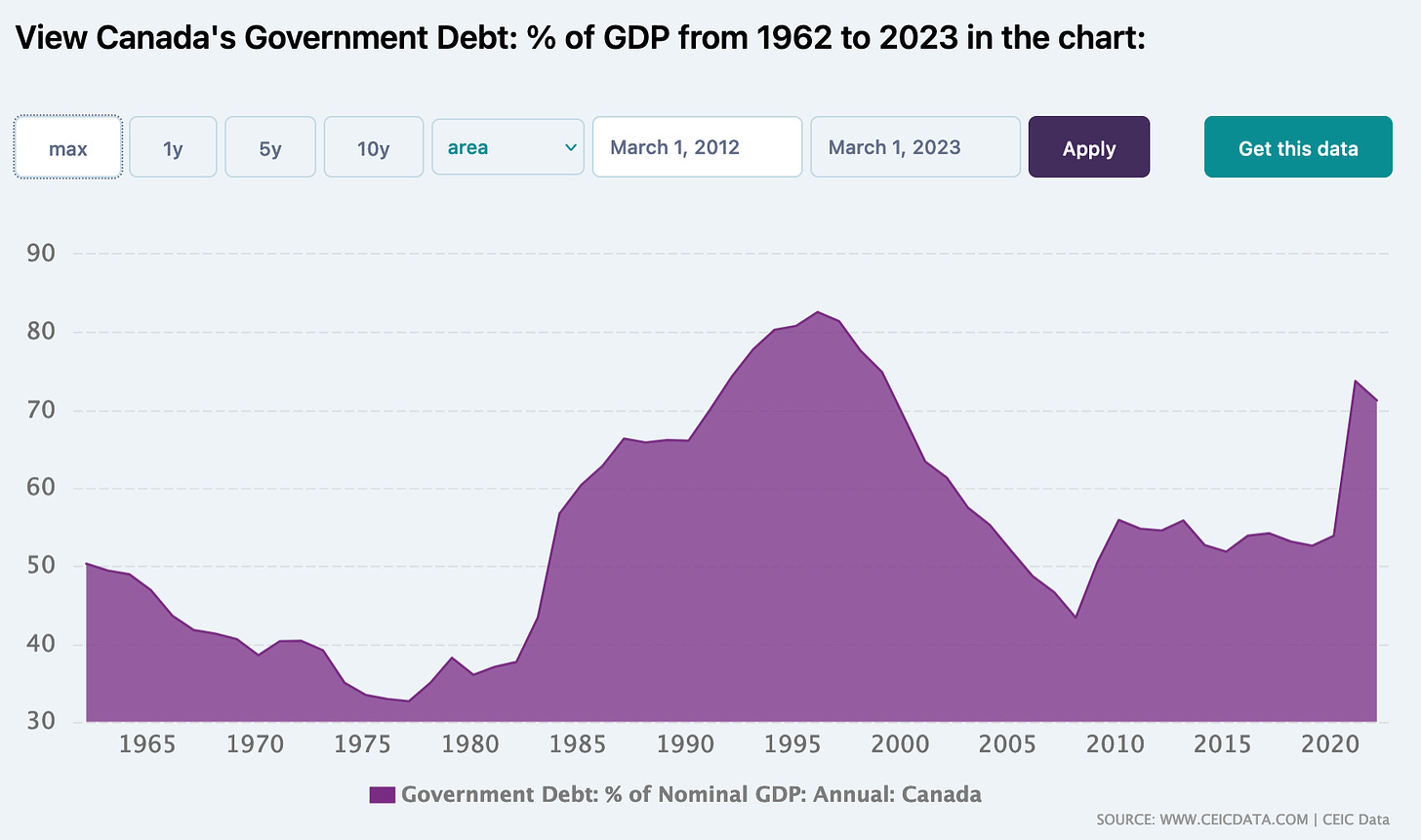

How does that compare to other places? At around 32% Nova Scotia is in the middle of the pack of provinces with Ontario’s debt ratio at 38%, Quebec nearing 40% and Alberta, ever the economic powerhouse just passing 10%. What about the rest of the world? It’s important to be careful about who we compare ourselves to. Most US states have a debt ratio in the teens with Hawaii being the most indebted state at nearly 20%. But the US federal government has a national debt of almost 125% of GDP compared to Canada’s federal debt at 66%. That Canada figure, down from 74% in 2021 due almost totally to COVID is low by country standards where the global average is about 100% of annual GDP. Canada’s average ratio since the 1950’s has averaged about 50%, with a big mountain in the 1990’s where it reached over 80% of GDP.

Things you won’t read in the headlines

Far from our biggest concern, Nova Scotia’s debt is well managed, low interest, used for good long-term purposes, declining compared to historical levels, and per person. It is also low when compared to other provinces, states, and countries.

Here’s a summary of some other interesting items from today’s Nova Scotia Budget. You can use the Is That A Big Number? question to decide how to think about all this yourself.

The Big Ideas and Changes

Beginning January 1, 2025, indexing personal income tax brackets, the basic personal amount and certain non-refundable tax credits to Nova Scotia’s inflation rate. It will be the largest tax break in the province’s history and will save Nova Scotians about $150- $160 million per year in taxes by 2028.

$7.8 million more for additional actions to reduce child poverty, including:

delivering the increased Nova Scotia Child Benefit

more support for young people leaving care at the age of 19

expanding the EDGE Program, which prepares youth at risk for education and employment success

$2.4 million more to create 500 new rent supplements, for a total of $69.2 million to help 8,500 households

$5 million more, for a total of $23.8 million, for the Home Repair and Adaptation Program to help more low-income homeowners

$1.2 million for the Fertility and Surrogacy Tax Credit to help offset costs of fertility and surrogacy related expenses

$3.2 million for the Children’s Sport and Art Tax Credit of $500 to support children participating in sports and arts programs

$26.5 million this year to provide the Seniors Care Grant to help older Nova Scotians stay in their home and communities

$18.2 million to return provincial income taxes paid by more than 10,000 seniors who also receive the Guaranteed Income Supplement

$1.2 million more, for a total of $10.4 million, for the Property Tax Rebate, which offers eligible seniors a rebate of half of their property taxes, up to $800

$60.9 million for about 200,000 families through the Affordable Living Tax Credit

$144.2 million for the Your Energy Rebate Program to eliminate the 10% provincial HST on home heating

Giving Children a Strong Start

$18.8 million this year to launch a new lunch program for students in the public school system. The program will roll out over four years and build to an estimated $100 million annual investment by 2027–28

$28 million more for our public schools to address growing enrolment, hire more teachers and address inflationary pressures

$1 million for Cape Breton University’s accelerated and expanded teacher training

$42.5 million more this year in child-care funding to lower fees for families, create more spaces and enhance after school care, fully recoverable from the Canada-Wide Early Learning and Child Care Agreement

$208.5 million to build and renovate schools across the province, including $30 million for capital repairs and $40 million for new modular learning spaces (Capital Plan)

$12.3 million more to pay early childhood educators more and help stabilize and grow the workforce across the province

$5.1 million more to increase rates and provide additional supports to foster children and their families, bringing the total annual funding to $16.7 million following the redesign initiative

$5.8 million more to support the redesign of provincial preschool autism services

$1.4 million more for Nova Scotia Hearing and Speech to significantly reduce wait times among preschoolers

Helping Nova Scotians Meet Their Needs

$84.6 million for initiatives under the Supportive Housing Action approach and other programs to address homelessness, including:

more supportive housing units

new supportive housing locations throughout the province

operational funding for shelter service providers

100-bed shelter in Dartmouth

70-bed shelter in Halifax

a new shelter exclusively for 2SLGBTQIA+ clients in Halifax

emergency shelter and support services for youth

$102.3 million to take action on the Human Rights Remedy by making significant changes within the Disability Support Program and helping people with disabilities to better meet their needs, including:

$53.3 million to deliver the new Income Assistance Disability Supplement – an additional $300 per month to about 15,000 people on income assistance who are not in the Disability Support Program

expanding community-based programming and individualized funding

adding new positions in the Disability Support Program to support clients and the implementation of changes related to the Remedy

supporting the transition and implementation of the Remedy

expanding and modernizing the technology used in the Disability Support Program

$16.4 million to support persons with disabilities living in institutions to transition into the community

$7 million more to transition young adults with disabilities out of long-term care into the community

$850,000 to raise the earned income exemption for Income Assistance clients

$7.1 million more, for a total annual budget of $16.9 million, to provide increased, permanent funding for Transition Houses and Women’s Centres in response to the Mass Casualty Commission recommendations

$2 million more, for a total of $2.5 million, for the Community Housing Growth Fund

$2.8 million under the Action for Health plan to continue improving equity across the healthcare system

$1.2 million for the Equity and Anti-Racism Strategy to support communities to address inequity and racism across the province

Implement the Province’s first African Nova Scotian Justice Action Plan and advance collaborative work on an Indigenous Justice Action Strategy

Thanks for reading All Lines Are Curves! Subscribe for free to receive new posts and support my work.