A Holiday Romance - Hallmark or Hullabaloo

Analysis of a Sales Tax Holiday on Groceries and Restaurant Meals: A Taxpayer's Perspective

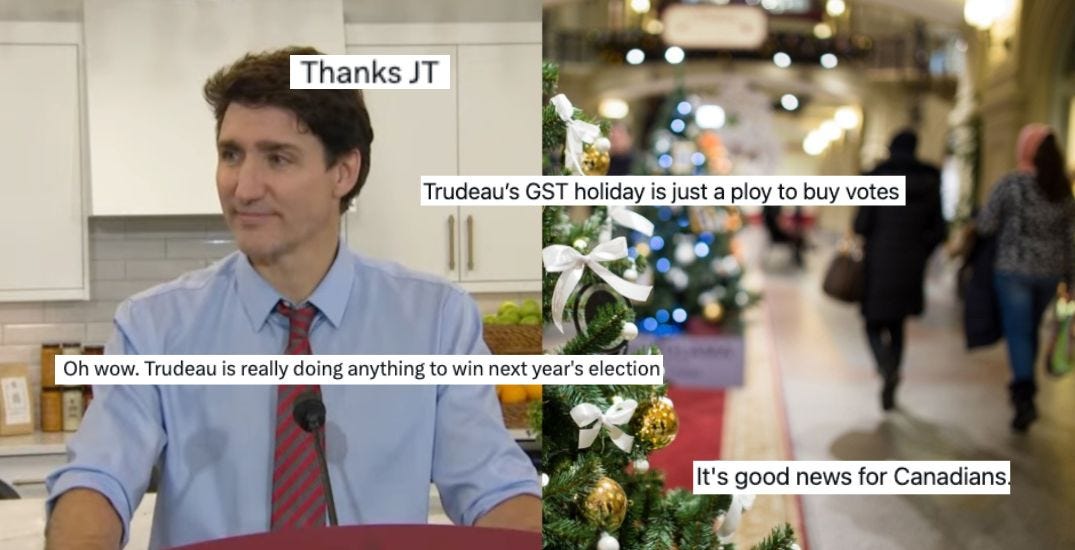

Today, Justin Trudeau surprisingly announced an unusual ‘tax holiday’ for Canadians’ Christmas.

Reuters Media Release: What’s it all about?

My Bias: It’s certainly no secret that I support targeted tax credits as an economic tool because they strike the perfect balance between encouraging growth and maintaining accountability. Unlike gifts (such as this tax holiday), grants, or subsidies, which can be prone to waste or misallocation, tax credits reward real directed, measurable activity—whether it's creating jobs, investing in infrastructure, or supporting those who need it most. They empower businesses to take the lead while ensuring taxpayers see a tangible return on investment. They can be focused to help specific communities, families, and individuals. I've seen firsthand how tools like labor-based film tax credits not only attract industries but also build lasting ecosystems that strengthen local economies. When designed well, tax credits drive sustainable growth without unnecessary bureaucracy, making them one of the smartest ways to foster economic development.

This essay explores the economic and accounting impact of the Canadian government’s decision to implement a sales tax holiday on groceries and restaurant meals for two months, applying principles from Harry Hazlitt’s Economics in One Lesson. Hazlitt emphasizes the importance of analyzing the long-term effects of policies on all groups, rather than focusing solely on short-term benefits for specific groups.

I appreciate that the tax holiday applies to a broader basket of goods and services, but I think to get a quick and complete analysis I’ll focus on the food part of the announcement today. The tax holiday on liquor, for example, deserves a separate analysis as its potential social and economic costs are wildly less predictable.

The assumption I’m making off the jump is that the sales tax holiday in Canada applies to the entire Harmonized Sales Tax (HST), encompassing both the federal and provincial portions. This means that during the holiday period, consumers in provinces like Nova Scotia, where the HST is 15%, will not be charged any sales tax on eligible groceries and restaurant meals. The assumption is that the federal government has coordinated with participating provinces to implement this comprehensive tax relief, ensuring that the full benefit is passed on to consumers and that the provinces and territories are somehow compensated.

You can find the government’s policy document and summary of impacts items here:

https://www.canada.ca/en/department-finance/news/2024/11/more-money-in-your-pocket-a-tax-break-for-all-canadians.html

Immediate Impact on Taxpayers

1. Savings for Consumers

The removal of sales tax reduces the total cost of groceries and restaurant meals for consumers.

Calculation Example:

If the average household spends $1,000/month on these items and the tax rate is 15% (e.g., HST in Nova Scotia), the household saves $150/month, totaling $300 over the two months.

2. Increased Disposable Income

Savings on tax could lead to:

Increased purchasing power for other goods or services.

Savings or debt repayment.

Behavioral Considerations:

Households with lower incomes, which spend a higher proportion of income on food, benefit more relative to income. This could temporarily reduce food insecurity for some families.

Economic Ripple Effects

3. Increased Demand

Lower prices might stimulate increased consumption of groceries and restaurant meals.

Restaurants, particularly those still recovering from pandemic impacts, may see higher foot traffic.

Grocery retailers might experience a spike in sales, especially for non-tax-exempt luxury food items (e.g., prepared meals).

4. Industry Dynamics

Restaurants:

Margins could improve if increased demand offsets rising input costs (e.g., food inflation, wages).

Unintended consequence: tips, when paid at debit machine prompts are calculated on bills including tax so staff and servers, if they can’t get this message out will see a 15% decline in income.

Groceries:

Retailers may face logistical challenges from increased demand, such as managing supply chains.

Potential for substitution effects as consumers shift from home cooking to dining out.

5. Inflationary Pressure

By stimulating demand, the policy could exacerbate inflation in the food sector, particularly if supply chains are constrained.

Restaurants and grocery stores might raise base prices knowing the consumer isn’t paying tax, diluting the real benefit of the tax holiday.

Opportunity Cost of Foregone Tax Revenue

6. Government Budget Impact

Revenue Loss:

If grocery and restaurant sales total $50 billion over two months, a 15% sales tax would yield $7.5 billion in revenue. The holiday removes this revenue temporarily.

Allocation Effects:

Reduced revenue impacts funding for other government programs, potentially requiring borrowing or cuts elsewhere.

Taxpayers ultimately bear this cost in the form of deferred benefits, higher taxes in the future, or increased public debt.

7. Deadweight Loss Reduction

Sales taxes create deadweight loss by discouraging consumption. The holiday eliminates this inefficiency temporarily, leading to a short-term boost in economic activity.

Counterpoint:

The effect is temporary and may lead to distortions, such as "stocking up" on non-perishable goods before taxes are reinstated.

Lingering questions

In Nova Scotia, the HST is made up of a 5% federal portion and a 10% provincial portion, a major source of provincial revenue. How is that going to be compensated and how will the different rates in provinces and territories be accounted for since the provinces with the highest GST/HST rates will benefit disproportionately?

UPDATE 11/22/24

Yep… the HST provinces, including Nova Scotia were blindsided and they have a big problem on their hands. See the CBC story linked in the picture. It doesn’t have any answers, but at least reveals the question.

How will tipped workers’ losses be accommodated if at all?

What are the political consequences/benefits of all this?

How difficult will it be to adjust accounting software and systems to accommodate the change?

How will it impact GST/HST filings, administration, and potential timing differences between tax credits and debits in some businesses?

How do we get out of this? A bit of a sidebar: Economist Milton Friedman used to say that nothing was so permanent as a temporary government program. He was right: Britain's income tax was brought in as a temporary measure to help fight the war against Napoleon (at six pence in the pound on incomes over £60), and it's still with them and income taxes are common to all western countries today. They say (can it still be true?) that in Germany Bismarck introduced a tax on champagne corks to fund the fleet; the fleet's now at the bottom of the ocean, but the tax remains.

Friedman might also have said (but didn't, at least in so many words) that nothing grows quicker than a government program, too. Government initiatives generally grow much faster than the national income, which is why so many of them are in a funding crisis today. Our social programs, for example, are larger than they have ever been before, despite the fact that real, abject poverty, still common in rural areas when I was a kid, is in fact a thing of the past. Almost all households have microwaves, mobile phones, and TVs, most have computers and internet, and nearly everyone has access to a washing machine and dryer. My grandparents grew up in a time when few would have even dreamed of such luxuries or even their contemporary equivalent.

The Bottom Line

While the sales tax holiday offers immediate relief and a boost to consumer spending, Hazlitt’s principles caution against ignoring long-term and secondary effects. The policy’s benefits are short-lived, disproportionately favor higher-income households, and risk distorting the economy. The lost revenue has hidden costs that will ultimately fall back on taxpayers, either through higher taxes or reduced public services. A more sustainable approach would focus on structural solutions to food affordability and economic equity.

My pitch? Targeted tax credits.

This is a work in progress that I’ll edit as more information becomes available.

Please comment with any other ideas, implications, concerns, and interests and we can work through it together.

"Hazlitt emphasizes the importance of analyzing the long-term effects of policies on all groups, rather than focusing solely on short-term benefits for specific groups." Welllll, at least this policy event focuses on a very inclusive specific group-all Canadians! So, not like a tax break to Shaw Enterprises or Irving or super-wind-farm proponents, eh? And the long-term effects/results could be a hike in taxes in the near future on those mentioned outfits and a few dozen others like Loblaws, Clearwater, Sobeys, McCaine, Rogers, Bragg, Big Oil, Resolute (or whoever they've become), Armoyan/Armco...I'm sure others are willing to help out with the list.